HKS Real Estate Advisors

Committed to Delivering the Highest Level of Service

- Acquisition & Bridge Financing

- Long Term Fixed and Floating Rate Recapitalization

- Mezzanine and Private Equity

- Construction Financing

INDEX RATES

Who We Are

2011

Established

$25 billion

In Transactions to Date

$2 billion

Avg. Annual Transaction volume

Established in 2011, HKS Real Estate Advisors has swiftly emerged as a leader in commercial real estate advisory. The firm closes more than $2 billion in annual transaction volume and has executed over $30 billion to date. HKS specializes in debt and equity advisory, working with clients on single assets, portfolios, development sites, construction projects, ground leases, joint ventures, and partial equity sales nationwide. Its financial services platform spans debt, equity, bridge, and joint venture financing, while its dedicated equity advisory arm connects clients with institutional and private investors to source and structure flexible, risk-tolerant capital solutions. HKS also supports select investment sale assignments as part of its broader advisory capabilities. The firm has been recognized as one of GlobeSt's Best Places to Work, named Real Estate Capital USA’s Boutique Debt Adviser of the Year, and featured on GlobeSt’s 2025 list of Rainmakers in CRE Debt, Equity, and Finance.

Notable Transactions

We have facilitated countless transactions in our successful history. Below are some of the deals we are most proud of.

Capital Advisory

300 East 34th Street

Manhattan, NY

Refinance / $75,000,000

131-02 40th Street

Flushing Square Plaza

Queens, NY

Development / $101,000,000

955 East 25th St.

Hialeah, FL

Development / $148,000,000

30-36 Crosby Street & 333 Main Street

Brookview Commons – Phase 1 & 2

Danbury, CT

Refinance / $58,000,000

69 Marlborough Street

Brainerd Place

Portland CT

Construction Loan / $35,000,000

0 Montana Ave

Jacksonville, FL

Ground-up construction / $76,000,000

3444 Main Highway & 3140 Grand Ave

Coconut Grove, FL

Refinance / $16,300,000 with $10,600,000 initial funding

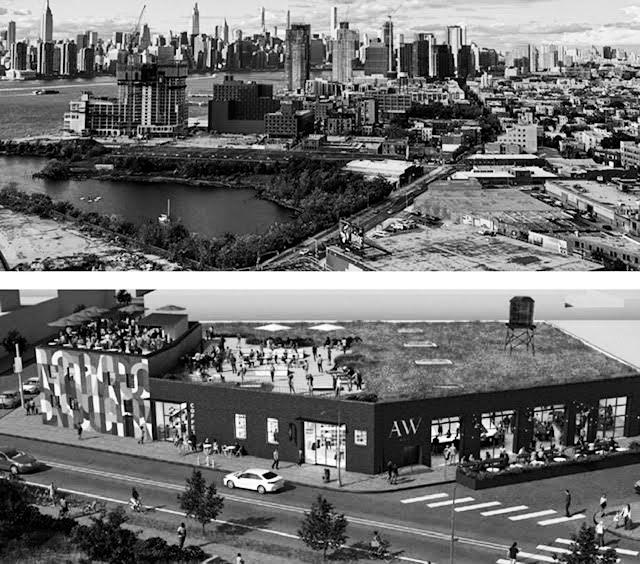

12 Franklin Street

Brooklyn, NY

Acquisition / $20,300,000

159-161 West 54th Street

Manhattan, NY

Acquisition and subsequent gut renovation / $37,710,000

901-991 E 26th St & 906-990 E 27th St

Metro Parc North

Hialeah, FL

Refinance / $18,000,000 ($17.25M funded, $750,000 once last parcel is acquired)

640 South Main Street

Cecil Hotel

Los Angeles, CA

Refinance / $50,000,000

4560 Broadway

Washington Heights, NY

Ground-up Construction / $37,000,000